The financial industry is facing a great revolution in terms of improving its traditional contact services centers into advanced and modern service contact centers. Traditional financial contact services centers are adapting generative AI solutions to enhance the overall customer experience and reduce the burden on financial centers. The conventional centers with their traditional contact services faced various issues like cost increment, dissatisfaction for the customers, wrong decision making, lack of predictive analytics, and not detecting fraud manually, that forced them to shift towards the gen AI financial services.

Financial institutions or organizations may now build highly customized client experiences thanks to GenAI. Consider chatbots that can comprehend intricate financial inquiries, produce customized investment recommendations, or deliver immediate, individualized loan offers. Delivering a smooth, customized experience at scale is the goal.

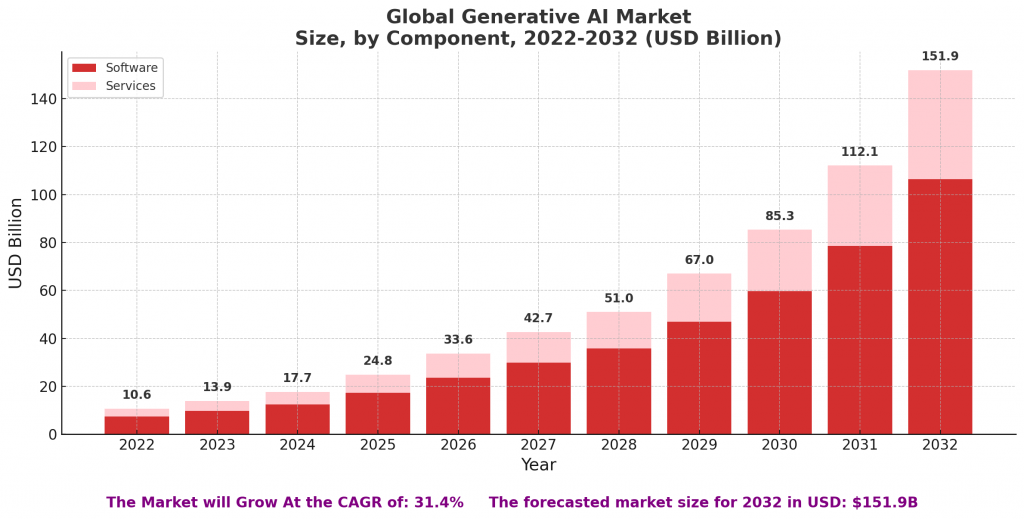

Generative AI Market Growth

The global generative AI in financial services market size is calculated at USD 1.95 billion in 2025 and is predicted to surpass around USD 15.69 billion by 2034, accelerating at a CAGR of 26.29% from 2025 to 2034.

76% of companies considered adding generative AI to their support in 2024. 53% of customers said gen AI will support companies in serving customers better and

71% of CX leaders believe Gen AI tools should be embedded into existing call center tools. Content creation (40%) and classifying customer interactions (31%) are the top Gen AI use cases in call centers. Where 57% of CX leaders predict chat-based customer support will be significantly influenced by generative AI.

What is Generative AI and Why Financial Services are Paying Attention to it?

Generative AI is a type of artificial intelligence or you can say an upgradation and advanced version of traditional artificial intelligence, that has capabilities to create content, analyze data, detect patterns, and much more for the various operations in various industries.

The financial sectors are moving towards the adoption of this technology at a very rapid pace due to its immense capabilities to not only enhance contact services but also provide various key benefits and applications for the financial industry. Gen AI can analyze data to detect risk patterns, AI-powered chatbots for better customer services, demand forecasting, real-time transaction monitoring, are the great applications of Gen AI financial services.

Explore more: Best Generative AI Solutions Providers for Businesses

Challenges Facing Traditional Financial Services Contact Centers

The traditional financial services contact centers faced various issues or challenges as here are a few key challenges mentioned below.

- High call volumes and long wait times for organizations and customers, respectively, are one of the challenges as traditional methods cannot enable the management of multiple queries at once.

- The traditional financial services contact centers were not able to meet the customer expectations as they could not analyze the customer’s data to provide better services according to their needs.

- Without any seamless technology, the traditional contact centers lack smooth communication with the customers, which also results in dissatisfaction for the customers.

- Various manual processes, routines, and repetitive tasks result in increased cost efficiency and manual labor for the financial contact services centers.

- Traditional financial contact services centers are not well aware of the regulatory compliances that result in penalties.

Also Read: How to Choose the Right Generative AI Consulting Partner

Top Use Cases of Generative AI in Financial Contact Centers

The generative financial services offer various top use cases for the financial contact centers as here are few key use cases mentioned below.

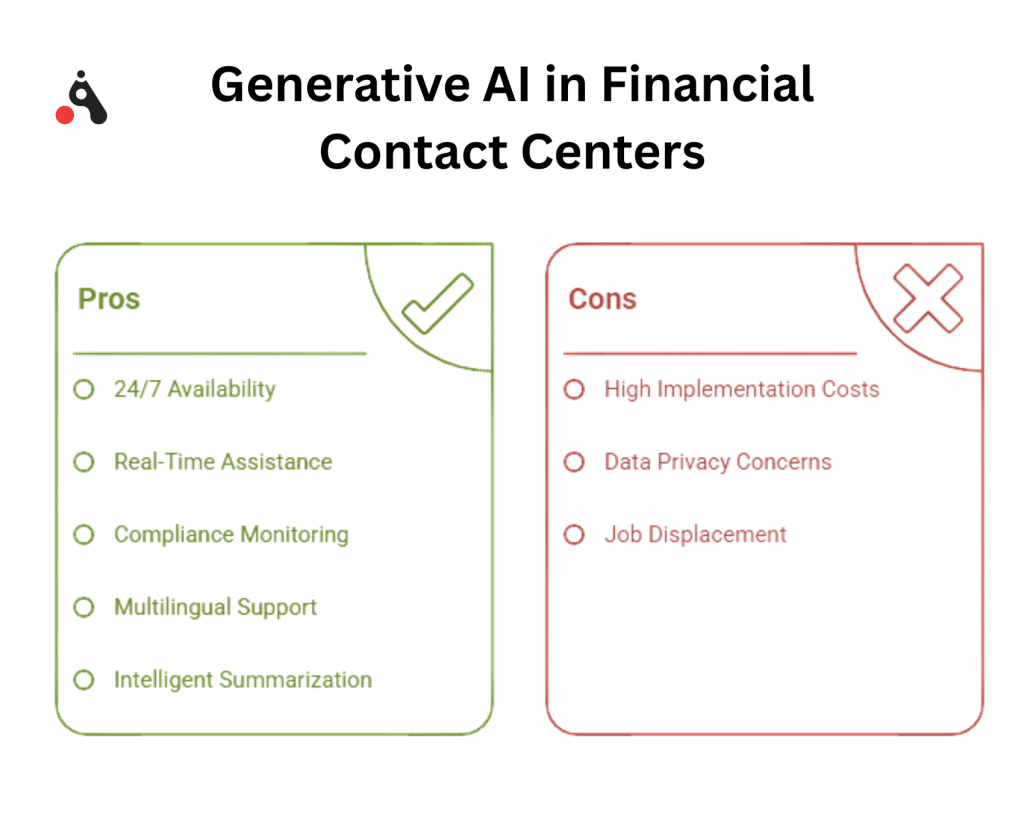

AI-Powered Chatbots and Virtual Assistants

The Gen AI-powered chatbots and visual assistants are one of the popular and most used use cases for financial services contact centers. Many other industries are implementing this application of the gen AI. The AI-powered chatbots replace human employees and can be available 24/7, where the customers can interact with the virtual assistant through voice to get solutions for their queries. The time availability, problem-solving efficiency provide a great experience to the customers.

Real-Time Agents Assistants

The real-time agent’s assistants are another advanced use case of gen AI financial services contact centers. The real-time agent’s assistant can analyze the customer’s sentiments, voice, intent to deliver the best possible results in real-time. This helps customers a lot to save their time and get the solutions within a fraction of a second.

Automated Compliance Monitoring

Compliance regulation is crucial in financial contact services centers, as proper management and information about compliance could lead to penalties. The gen AI financial services solutions can be applied to get the right measurement and monitor the compliance, which can immediately inform if any regulatory compliance is altered.

Multilingual Support and Translation

The traditional financial contact services centers always faced problems when it came to providing services for various regions. Language becomes a barrier in communication, and it is also hard to translate. The AI chatbots in banking or financial sectors can support multiple languages and translate other languages into one another to provide a great versatility of services for various regions.

Intelligent Call Summarization

Generative AI in customer services does just not only enables chatbots but also provides a clear summarization of the call of customers. The system analyzes the speech in real-time and identifies the keywords. This allows Gen AI to understand the customer’s queries and patterns immediately to provide them with solutions.

Also Read: The Role Of Generative AI Solutions for Business

Benefits of Generative AI in Customer Service For Finance

There are various benefits of generative AI in customer service for finance. Here are a few key benefits mentioned below.

Faster Response Time

Generative AI financial services offer faster response times in comparison to traditional financial contact services. The gen AI algorithm detects and analyzes the data provided by the customers in the chat box. After analyzing the data, the results appear to the customers as soon as possible with better accuracy than manual contact financial services.

Consistent and Policy-Aligned Services

Consistency is the key to success for the financial industries that cannot be achieved manually and traditionally. Another factor is that the services should align with the mentioned policies to prevent any type of issue by the governing authority. The gen AI financial services provide solutions for problems at a constant pace and also make sure that financial institutions and contact services run with proper policies.

Lower Operational Costs

The financial organizations include various repetitive tasks like counting, billing, and data management, that cost too much with the manual and traditional management system. Where the gen AI financial services can automate the various repetitive tasks to prevent costs and overall enhance cost efficiency.

Enhances Customer Satisfaction Scores

Customer satisfaction score means a lot for financial contact services as it cannot improve with manual methods. The gen AI financial contact services are very advanced, fast, and efficient to provide better and enhanced services to the customers. The happier and satisfied customers, the higher customer satisfaction scores.

Increases First Call Resolution

First call resolution is the method to get the data on how many customers got the correct solutions for their queries at once. Manually, it would take multiple calls to understand the customer queries, whereas the gen AI-powered intelligent call summarization can analyze the problem in one that overall increases or improves the first call resolutions.

How Leading Financial Institutions Are Using Generative AI

Leading financial institutions are using generative AI not just to improve their customer service aspects but also for various operations. They implemented the gen AI solutions for predictive maintenance, better marketing and advertising programs, analyzing large datasets for trend identification, generating synthetic data for model training, better content generation and innovation tips, for enhancing the security of transactions, to provide better support to the customers in multi-languages anytime, automating tasks, improving risk management, and streamlining internal operations.

These use cases and applications of generative AI give them a competitive edge, which is why they are recognized as leading financial institutions.

Also Read: Benefits of Smart Manufacturing with Generative AI Solutions

How to Deploy Generative AI in Financial Contact Center

Deployment of gen AI in a financial contact center involves various stages as here are a few mentioned below.

- Identify the objective of deploying the gen AI for the financial contact center.

- Focus on the high-priority areas where gen AI can get the most value like customer interaction, fraud detection, and risk management.

- Choose the right-gen AI model and infrastructure type as to which type of software and hardware would be suitable for your financial contact center.

- Build a team and hire specialized and expert developers. Also, acknowledge them for what you are expecting of them, and train the employees.

- Make assured that the security measures and data management system are integrated into the gen AI system to safeguard customers’ data.

- After this, deploy the gen AI in the contact center and continuously monitor to make timely maintenance and upgradation.

How to Measure AI Success in Financial Contact Centers

Measurement of AI success in financial contact centers is crucial as this provides an area of improvement and enables more advancements. There are various aspects that influence AI success in the financial contact centers, like paying attention to customer happiness, first-call resolution, and agent performance in order.

To evaluate AI’s effect on customer experience, monitor measures such as First-Contact Resolution (FCR) rate, Customer Effort Score (CES), and CSAT scores.

To learn more about how AI affects agent productivity and burden, track measures like average handle time, hold times, and agent empowerment.

Also Read: Implementing Generative AI For Customer Service Solutions

Final Take

Generative AI financial services are evolving the way of helping customers through financial contact services. We have seen detailed information like key benefits, use cases, performance measurement, and implementation guides, that are very essential to make financial contact services better than ever before.

With Aeologic Technologies as your trusted tech solution partner, you can leverage cutting-edge AI innovations to transform your contact center operations. The gen AI financial services are just beyond our imagination and have a brighter future than today. This not only improves the way of contact services but also introduces an innovation that is going to enhance the financial sector for a long time.

FAQs

How can generative AI help reduce wait times in my financial contact center?

Generative AI automates responses to common customer questions instantly, freeing up human agents to focus on complex cases. This reduces overall wait times and improves call handling speed, enhancing customer satisfaction.

Will implementing generative AI require major changes to my existing contact center systems?

Most generative AI solutions are designed for easy integration with existing CRM and telephony systems. They can gradually deployed alongside human agents to ensure a smooth transition without disrupting current operations.

Can generative AI handle regulatory compliance and sensitive financial data securely?

Yes, leading generative AI platforms comply with financial industry regulations and use advanced encryption and data protection measures to ensure all customer data remains secure and confidential.

How quickly can my financial services contact center see ROI after deploying generative AI?

Many organizations report significant improvements in operational efficiency, reduced staffing costs, and enhanced customer experience within 3 to 6 months, leading to a measurable ROI soon after implementation.

Can generative AI improve personalization in customer interactions at my contact center?

Generative AI analyzes customer data and previous interactions to generate personalized responses, also, tailored offers, and proactive support, helping build stronger customer relationships.

What types of customer queries can generative AI handle in financial services?

Generative AI can manage FAQs, transaction inquiries, account updates, loan application status, fraud alerts, and even assist with complex tasks like financial advice, with human oversight for sensitive issues.

How cost-effective is generative AI for financial services contact centers?

Generative AI helps reduce costs by automating repetitive tasks, lowering the need for large call center staff, and improving first-contact resolution rates. While initial investment varies, many financial institutions see significant savings within months through reduced operational expenses and increased efficiency.

How much does it typically cost to implement generative AI in a financial services contact center?

The cost of implementing generative AI varies based on factors like the size of your contact center, complexity of integration, and customization needs. So, Pricing models often include setup fees, subscription or licensing costs, and usage-based charges. Small to mid-sized centers may start with packages ranging from $10,000 to $50,000 annually, while large enterprises might invest more for advanced features and scale. Many vendors offer flexible pricing to match your budget and goals.

I’m Deepika Pandey, an SEO strategist and content writer with 6+ years of experience. I create SEO-friendly content that drives traffic and engages readers. I combine data insights with creativity to help businesses grow their online presence effectively.