The adoption of generative AI in private market asset management is increasing steadily. The conventional method of managing assets in private markets and businesses does not enable them to withstand the rough and tough competition.

However, generative AI providers forced marketers to adapt because of its ability to revolutionize several areas of their business. This technology, which creates content from vast amounts of data using deep learning techniques, is not only a futuristic idea but a current reality that is drastically changing the industry.

The generative AI has an excellent ability to forecast market trends, which aids managers in taking preventative action. It enhances risk assessment algorithms, which results in more intelligent strategies. Automating reports and instantly updating portfolios improves operational efficiency and streamlines procedures.

The generative AI solutions in private market asset management is the game-changer that asset managers have been looking for for many years. Finally, they got the right solutions in exchange for their patience which surely boosted the growth of their asset and enhanced their market position.

Rise of Generative AI Adoption in Asset Management

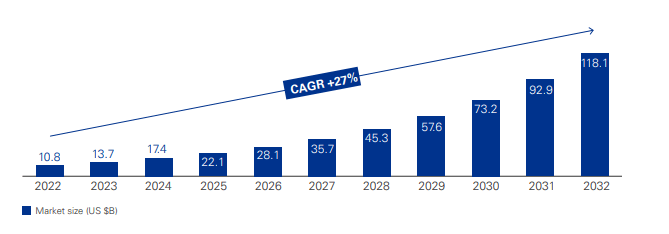

The Global Generative AI in Asset Management Market size is expected to be worth around USD 3,109.5 Million by 2033, from USD 289.4 Million in 2023, growing at a CAGR of 26.8% during the forecast period from 2024 to 2033.

A significant portion of asset management firms are actively using or experimenting with GenAI, with 36% already in use and 33% in the experimentation phase.

46% of companies are developing their AI capabilities entirely in-house, while 40% are adopting a hybrid approach, combining internal resources and external partnerships. The primary challenges include data quality and maintenance (19%), understanding costs and building a business case (15%), and accessing AI expertise (13%).

Over the next year, 37% of companies will focus on expanding AI use, 22% will increase experimentation, and 28% will monitor progress.

The most popular applications of Generative AI (GenAI) include document synthesis (28%), data extraction (28%), and knowledge bases/Q&A (17%).

As we can see, the market for generative AI in asset management is growing rapidly, backed by strong adoption and investment trends. Firms are not only experimenting with AI, they’re actively building capabilities and applying it across core operational areas.

Explore more: How Businesses Can Leverage Generative AI Solutions for Growth

What is Generative AI in Private Market Asset Management?

Generative AI in private market asset management refers to using cutting-edge AI models, such as Generative Adversarial Networks (GANs) and Variational Autoencoders (VAEs) that create fresh material or insights about risk management, investment strategies, and customer interaction.

Simply, these AI models can increase productivity and investment results by automating processes, analyzing enormous volumes of data, and customizing services for customers. Generative AI in private market asset management offers a lot of benefits as enhancing investment strategies, managing risks, improving client engagement, and streamlining operations, but it also addresses the potential challenges in the adoption of generative AI that we will see later.

Related Blog: How Generative AI is Revolutionizing Industries in 2025

How Generative AI Works in Private Market Asset Management?

Generative AI within private market asset management operates through the utilization of sophisticated machine learning models that survey extensive amounts of financial and market data to produce realistic simulations, predictions, and insights. These AI models are able to learn about asset performance from the past, market conditions, economic indicators, and alternative data to provide multiple potential future scenarios for investments.

The first step involves data ingestion, whereby structured and unstructured data are obtained from financial statements, news stories, transaction data, and others. The generative AI will then impose this data to construct probabilistic models that can simulate a number of outcomes, such as asset valuations, risk exposures, or portfolio return expectations, amongst many other scenarios, all under varying market conditions.

By generating these scenarios, asset managers can explore investment strategies, determine risks that otherwise might be hidden, and improve asset allocations without making rigid assumptions from historical or overly simplistic forecasts. This process engages asset managers dynamically with the future, better preparing them for shifts in the market while empowering them to make informed decisions more confidently.

Moreover, generative AI is capable of automating mundane tasks such as due diligence reporting, performance analysis, and risk assessments, creating time for human intelligence to focus more on insights and managing relationships effectively.

In conclusion, generative AI operates as a powerful decision support tool which makes private market asset management processes even better by improving its accuracy, speed, and depth.

Also Read: The Role of Generative AI Consulting Services in AI Adoption

Top Benefits of Generative AI In Private Market Asset Management

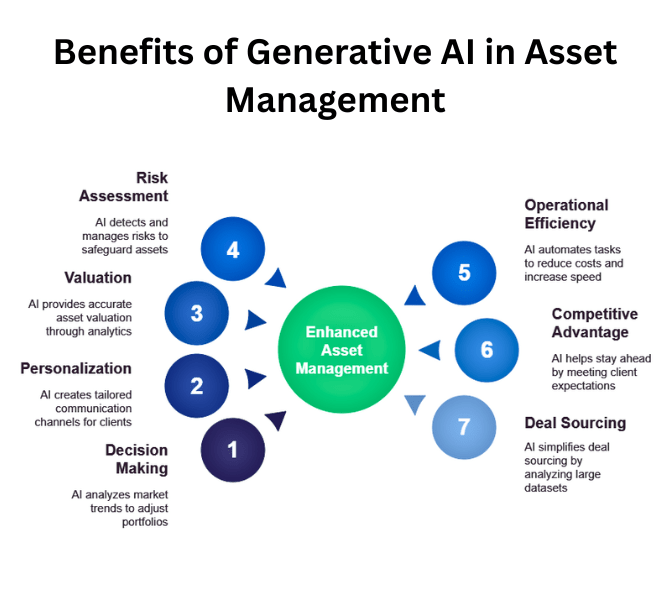

The generative AI in private market asset management offers various benefits as here are a few key benefits mentioned below.

Enhances Decision Making and Personalization

The generative AI in the private market for asset management can analyze the activity of the market trends and make changes in the portfolios according to that. It also enables personalized communication channels for the clients that help to generate new and innovative investment ideas. Also, the generative AI algorithm can conduct research for new products that could give you the best return on investment. Overall, the generative AI in private market asset management manages the investment factor to generate profit.

Improved Valuation and Risk Assessment

Valuation and risk assessment are crucial factors for the enhancement of asset management in the private market. The generative AI predictive analytics capability analyzes the market trends, compares the competition prices, etc to provide the right valuation of products and assets. Also, deep analytics helps private marketers detect and manage the risk to safeguard assets and data. Overall, it creates a safer and right valuation environment for assets.

Operational Efficiency and Scalability

The traditional asset management system does not allow nontechnical employees to manage the assets in the private markets. Generative AI also enables nonprogrammers to make the most of AI to enhance operational efficiency. It enables financial planning to reduce the operational costs as much as possible. The generative AI in private market asset management can also automate routine tasks that reduce labor costs and enhance the pace of operations completion.

We offer: RFID Solutions For Asset Management

Competitive Advantage

Staying ahead in the competition matters the most as traditional ways cannot help too much. The investment in generative AI helps private marketers keep up with other companies. This helps to fulfill the evolving client expectations for personalized, real-time services. The better the client is satisfied, the more you gain profit and this could only be possible by staying ahead in the competition.

Deal Sourcing

Deal sourcing enhancement is another important benefit of generative AI for private marketers. The time spent on deal sourcing is thought to be cut by at least 50% with generative AI. Simplified Due Diligence and Deal Sourcing. It’s no wonder that generative AI tools have become the buzzword. It facilitates the analysis of large datasets to produce insightful conclusions.

Also Read: Generative AI for Business Growth with Benefits and Use Cases

Top Success Factors for Implementing Generative AI In Private Market Assets Management

To make generative AI successful for private market asset management, it is important to understand the critical factors for implementing generative AI. Here are a few key factors mentioned below.

Strategic Planning and Clear Objectives

The first and one of the most important factors is to understand the objective for which you are implementing generative AI in the private market. After identifying objectives, make a strategic plan that helps to make the most of the generative AI for asset management without any inefficiencies.

Data Management and Technology

Data management is surely important as it involves key and confidential information. Choose the right technology with the gen AI that can manage data efficiently. Develop a sufficient and advanced data storage system that avoids any type of interference from external risk factors. Also ensure data is clean, consistent, and properly formatted for optimal AI model performance with the data management factor.

Organization Readiness

Organizational evolution with the implementation of generative AI is also an important factor in making the generative AI. Assign a person for the generative AI implementation, provide training and classes for the employees to make proper use of gen AI for asset management, and create an environment in which employees could adapt to the changing trends and technologies.

Risk Management and Ethical Considerations

With the generative, great benefits come with greater risk. So this is crucial to implement a system that has all security measures to avoid any type of risk. Also, establish or implement the ethical guidelines for the use of GenAI to ensure responsible and accountable decision-making. The better risk management efficiency, the more beneficial for private marketers to save their assets.

Monitoring and Continuous Improvement

Monitoring and continuous improvement are other key factors as it is important to analyze the performance of the generative AI while managing the asset. Make regular upgrades and maintenance for long-term service. The more regular maintenance, the more long-term return on investment would be made with the generative AI.

Collaboration of Technical Teams and Business Teams

One of the underappreciated factors of success is multi-functional collaboration. Make sure you have both technical experts and business stakeholders in alignment. When data scientists, asset managers, and leadership teams come together, you can deliver a GenAI solution that is more effective, relevant to your business goals, and scalable.

Scalable Infrastructure and Integration Capabilities

Generative AI models need scalability and flexibility in the infrastructure used. Choose tools and platforms that can expand if your business requirements change. You should also consider systems integration, in terms of existing asset management systems, whether that is a CRM system, analytics tool, portfolio tracker, etc. Integration is important for processing ability, as well as faster ROI.

Also Read: The Future of Advanced Generative AI Solutions for Business

How Much Does It Cost to Implement Generative AI in Private Asset Management?

The cost of implementing generative AI in business can range from a few hundred dollars per month to $190,000 (and counting) for a bespoke generative AI solution based on a fine-tuned open-source model.

Basic applications can range from $20,000 to $150,000, while more advanced applications can cost between $100,000 and $500,000 or more. Factors like the type of training data, the complexity of the models, and the integration with existing systems all influence the final cost. There are various individual factors that influence the overall costs as mentioned below.

- Pre-built datasets can cost $10,000 to $100,000. For collecting data internally, additional costs will be required for tools, staff, or even user consent processes.

- Outsourcing annotation will cost $5 to $50 per hour, which quickly adds up for large datasets.

- Renting cloud GPUs on platforms like AWS or Google Cloud can cost anywhere from $10,000 to over $100,000, depending on the model’s size and training duration.

- Data scientists, machine learning engineers, and DevOps professionals ensure the model works as you want. However, salaries for these roles often start from $100,000 and go up to $200,000 per year.

- To make AI work seamlessly with your current tools (e.g., CRM, ERP, or customer-facing apps), you’ll need custom development. Integration projects typically cost $10,000 to $50,000.

- Update or retraining can cost $5,000 to $50,000, depending on the model’s size and how frequently you update it.

| Cost Component | Estimated Cost Range (USD) | Key Notes |

|---|---|---|

| Basic Generative AI Application | $20,000 – $150,000 | Ideal for basic automation and document generation |

| Advanced Generative AI Application | $100,000 – $500,000+ | Includes advanced features, custom models, or large-scale systems |

| Pre-built Datasets | $10,000 – $100,000 | Depends on size, source, and relevance of dataset |

| Internal Data Collection (tools, staff, consent) | Varies (additional to dataset costs) | May include survey tools, staffing, and compliance |

| Outsourced Data Annotation | $5 – $50 per hour | Hourly costs scale quickly with large datasets |

| Cloud GPU Rental (AWS, Google Cloud) | $10,000 – $100,000+ | Cost varies by duration and compute requirements |

| AI Talent (Data Scientists, ML Engineers, DevOps) | $100,000 – $200,000/year | Salaries vary based on region and experience |

| System Integration (CRM, ERP, etc.) | $10,000 – $50,000 | Depends on system complexity and existing tech stack |

| Model Updates/Retraining | $5,000 – $50,000 | Depends on model size and update frequency |

Explore more: How Much does it Cost to Build a Generative AI?

Why Choose Aeologic for Generative AI?

When it comes to working with generative AI solutions, selecting the right partner is key. Aeologic Technologies is an experienced partner that you can trust to quickly and efficiently innovatively create AI-based solutions specifically for your business.

Aeologic combines deep technical know-how with industry experience, to well design and deploy generative AI models to accurately create simple and complex solutions. Whether your goal is to optimize asset management; automate workflows; or deliver insight from existing data, Aeologic creates powerful generative AI solutions that are agile enough to meet your business needs it makes sense as it is relevant to your organization to generate value.

Their customer-first approach means each project receives bespoke attention from concept to completion and ongoing support – their goal is to optimize your ROI with AI, and help clients get through contentious transformations to empower their future and maximize their engagement and delivery of digital transformation. Aeologic invests in quality with clients and focus on security and leverage technology will facilitate your easiest journey to gain the maximum potential of generative AI.

Choose Aeologic and partner with a team that thinks outside the box, providing not just solution delivery but clarity as you navigate the AI landscape with trust.

Looking for? Best AI Consulting Companies

Final Take

Generative AI is going to be the most significant reason for the advancements in asset management. The generative AI in the private market allows better techniques, accuracy, and efficiency than manual methods. The future seems bright also as it can be estimated with the changing landscape of the digital world. The daily upgrades and better versions of AI are going to provide the best possible applications and benefits for private marketers.

Overall, generative AI is becoming a necessary tool for private marketers, not just for asset management but also to keep up with the flow of advanced evolution.

📞 Contact us at +91-120-3200058 📧 Email us at support@aeologic.com to learn how we can help your business grow with generative AI solutions.

FAQs

How is generative AI transforming private market asset management?

Generative AI is reshaping private market asset management by enabling deeper data analysis and predictive insights. It can generate realistic market scenarios, simulate investment outcomes, and optimize portfolio allocations. This leads to improved decision-making, risk mitigation, and more efficient asset valuation processes, giving managers a competitive edge.

Can generative AI help in forecasting private market asset performance?

Generative AI models analyze historical data, market trends, and external factors to create multiple potential future scenarios. These simulations enhance forecasting accuracy for asset performance in private markets, helping managers better anticipate returns and market shifts.

What are the risks of using generative AI in private asset management?

While generative AI offers powerful insights, risks include over-reliance on AI outputs without human oversight, data bias, and potential model inaccuracies in volatile markets. It’s essential to combine AI-driven recommendations with expert judgment to manage these risks effectively.

How can generative AI improve due diligence in private market investments?

Generative AI can automate and enhance due diligence by quickly generating detailed reports, identifying hidden risks, and simulating various investment scenarios. This reduces manual workload, speeds up the process, and uncovers insights that might be missed by traditional methods.

Is generative AI suitable for smaller private asset management firms?

Generative AI tools are becoming more accessible and scalable. Smaller firms can leverage these technologies to compete with larger players by improving portfolio management, risk assessment, and operational efficiency without massive resource investments.

I’m Deepika Pandey, an SEO strategist and content writer with 6+ years of experience. I create SEO-friendly content that drives traffic and engages readers. I combine data insights with creativity to help businesses grow their online presence effectively.