The adoption of radio frequency identification (RFID) technology in the banking industry is growing at a steady rate. This growth is being driven by the increasing demand for transparency and efficiency, as well as cost savings opportunities that RFID brings to organizations.

Let’s begin!

Table of contents

- Introduction

- What is RFID Banking?

- How RFID Helps the Banks

- Why Radio Frequency Identification Tags

- Unique Capabilities of RFID

- RFID Banking Benefits

- Conclusion

Introduction

RFID technology is used in banks and other financial institutions to manage and control access to their premises and customers. The RFID tag attached to the entrance gates will enable only those people with an RFID-enabled smart card can enter the premise.

Another interesting way of using this technology is that you can use it for logging into your computer when you want to access your bank account online or even pay via debit card at a store using your Debit or Credit card which looks like a chip with a magnetic strip on one side and an embedded microchip on the other side.

What is RFID Banking?

When a customer using a Radio Frequency Identification (RFID) card completes a transaction and leaves the bank, the system records his/her exit.

RFID applications in banking include customer relationship management, tracking, and tracing, money transferring, counterfeiting countermeasures, contactless smart cards, person identification, phone banking, and security.

RFID tags affixed to items or smart cards hold data that may be read using radio waves and shown on a display. Data can be automatically sent to an IT system for processing.

Also Read: The Role of AI in Education And Learning: Just Promises Or Revolution

How RFID Helps the Banks

RFID is used in banking areas to secure their premises and customers. The following are the ways by which RFID helps the banks:

- A valid smart card is needed to enter the premise and even this can be done only after you have entered your pin code or password on your mobile phone. You do not need an ID card or any other document required to enter a bank’s premises because all you need is just this one thing, a valid smart card.

- For example, if you are going shopping at a supermarket, then after paying for your items, they will ask for scanning of goods on their mobile phones so that the verification process can be completed without any hassle whatsoever. So, if there was no need for such verification before, how would they verify now? You see how easy it becomes when using RFID technology in the banking industry.

Why Radio Frequency Identification Tags

Radio frequency identification (RFID) is a technology that embodies sophisticated electronics, computers, and radio waves for the purpose of reading, writing, and tracking information embedded in tags. It can be used for identifying objects or people based on their location. The tag may be attached to an object such as a product, animal, or person; it could also be incorporated into packaging materials or other items such as clothes.

A reader uses an antenna to detect signals from RFID tags. The signal is then processed by computer software which extracts data from this data store. This may include details such as its manufacturer’s name and model number along with its serial number so you can track it through your supply chain if necessary.

Also Read: Why Is CRM Software a Game-changer When It Comes to Delivering Better Customer Experiences?

Unique Capabilities of RFID

RFID is a wireless communication technology that uses radio waves to transmit and receive data. RFID tags are used to track objects, such as packages or vehicles. They can be read from a distance, which makes them a good choice for automatic identification and data collection in environments where physical access is limited or equipment needs to be moved frequently (such as warehouses).

RFID tags can also be embedded inside objects such as paper documents or plastic packaging material so they can be scanned whenever the thing comes into contact with an electronic reader device mounted on an automated system like a scanner at a bank teller window.

Boost your business with our RFID Solutions!

RFID Technology in Banking Systems

Banks are attempting to provide better services to their consumers by utilizing cutting-edge technology. RFID tags are used to identify, track, monitor, verify and provide more satisfying services to customers such as reduced waiting time, and the ability to bring security, accuracy, and integrity to the country’s banking systems by accelerating most banking operations by using electronic infrastructures without disrupting special customers.

It may assist in having complete visibility of assets, inventory, clients, and personnel in order to meet the banking demands of clients.

Also Read: How RFID Solutions Help in Inventory Management

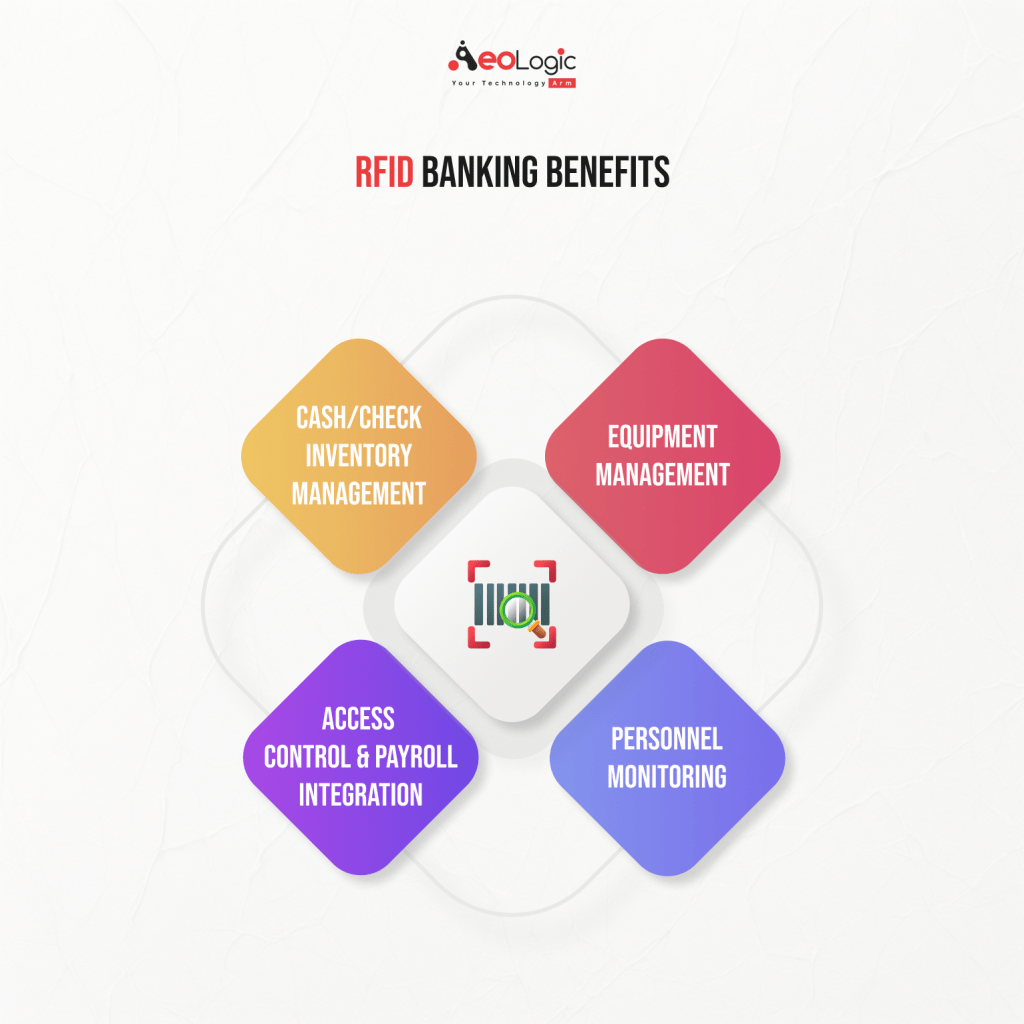

RFID Banking Benefits

Every stage of the banking procedure is important to your clients’ banking experience. Assets, inventory, clients, and personnel must be visible to meet banking demands. RFID may be used to:

- Cash/check inventory management

- Equipment Management

- Access control

- Personnel monitoring and Payroll integration

Cash and check inventory management – Clients need a steady flow of cash and checks to trust their bank. RFID tags make tracking assets easy. Automatically identify asset location and inventory level. Using RFID asset monitoring, verify inventory levels and order arrival dates to ensure every customer is cared for to your organization’s high standards.

Equipment Management- Asset monitoring systems can track maintenance schedules of cash sorter machines, ATMs, PIN Pads, teller assist units, and vaults. This ensures equipment is compliant and operating properly.

Access control- Using an access control system, bank zones may be assigned and monitored. According to work requirements, employees are given RFID badges with appropriate access levels. RFID badges can also unlock safety deposit boxes. Every time a box or room is accessed, it’s logged into the main database. Administrators may see real-time access and restrictions.

Personnel monitoring and Payroll integration- Personnel monitoring and payroll integration This data may be connected with current payroll systems for easy payroll calculations.

Conclusion

On the whole, RFID is a very effective technique that can help banks to improve their security. Banks are using this technology as an extra layer of protection against potential threats. It will also help in reducing losses and fraud by providing complete information about each transaction which is important for financial institutions.

Keeping your fulfillment process steady is made easier with the use of automation technology for effective automation solutions in your business. Get in touch with Aeologic Technologies right away to see how it can benefit your company.

Also Read: 10 Ways to Use Artificial Intelligence to Improve Business Processes

Related Blogs:

- How AI/ML Can Change the Public Transportation Industry

- Transforming Business With Digital Technology in the Oil Palm Industry in India

- Importance of Digital Asset Management in the Retail Industry

- How AI is Transforming the Agriculture Industry

- 10 Ways to Use Artificial Intelligence to Improve Business Processes

- The Future of IoT Technology in Convenience Stores

- Building Manufacturing Resilience Through AI and ML